Orleans Marketsnapshot January 2023

For prospective homebuyers, the Orleans home market can be daunting to navigate. Prices have risen significantly over the past few years, and understanding the current trends is essential for making sound decisions when buying a home. This blog post will take a look at the Orleans home sales in January 2023 compared to previous years, so that buyers can get an idea of what to expect when looking for a house.

January 2023 Home Sales Compared To Previous Years

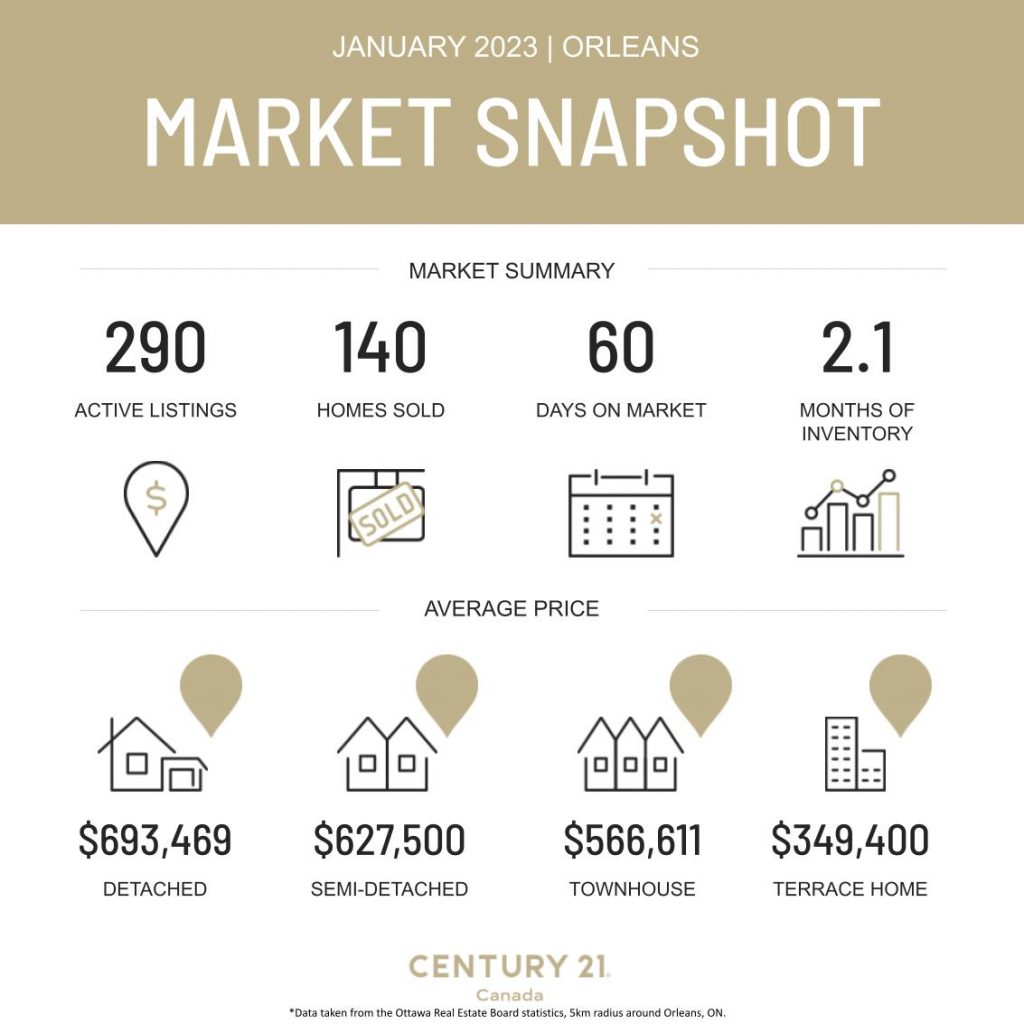

The Orleans real estate market saw a decline in home sales this January compared to previous years. According to data from the Ottawa Real Estate Board (OREB), there were only 140 homes sold in Orleans this month—a slight decrease from last January’s total of 161 homes sold. The average sale price came out to $650,753—a significant decrease from January 2022’s average sale price of $766,411.

Year-Over-Year Statistics

When comparing January 2023 with January 2022, it is clear that there has been a significant decline in the number of homes sold and their corresponding prices. In January year over year, terrace homes or stacked homes saw a sale price decrease of $96,067, townhomes or row homes saw a decrease of $98,163 and the most significant price decrease came in single detached homes which were down $165,379 compared to the previous January sales. These figures suggest that now might be a good time for buyers looking for deals on homes in Orleans as prices have dropped enough to make them more affordable than they were last year.

Mortgage Rates and Interest Savings

In addition to lower prices on homes, fixed mortgage rates are also currently low compared to variable rates which means buyers can save even more money on interest payments over the amortization period. According to data from Ratehub Canada, the current five-year fixed rate mortgage rate is 4.44%, compared to 5.55% for a variable mortgage rate —a savings of 1.11%. Buyers who take advantage of these lower fixed rates could save hundreds or even thousands of dollars over the life of their loan depending on how much they borrow and how long they keep it for and will have a peace of mind that their rates won’t be going up during the 5 year term.

Orleans home sales are down significantly compared to last year but prices remain relatively stable despite the pandemic’s impact on the housing market overall. Now may be an excellent time for prospective buyers who are interested in purchasing a home in Orleans as prices have dropped since last year due to decreased demand for housing inventory in the area and the multiple Bank of Canada interest hikes. With careful research and analysis potential buyers can find great deals on properties if they know where to look and take advantage of current conditions in the market today! Call Marc-Andre to help you find the right home for you!

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link