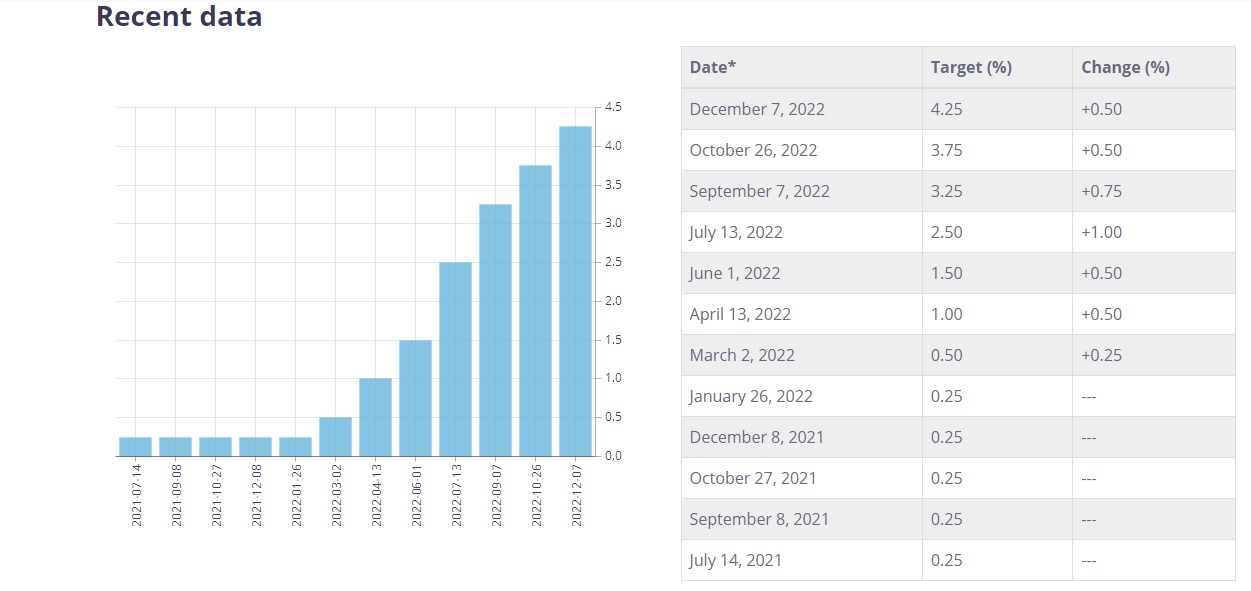

Bank of Canada Interest Rate Hikes in 2022

Just in, the Bank of Canada (BoC) raised their key interest rate from 4.25% to 4.50%. This increase in rates can affect mortgages especially variable mortgages and the amount of borrowing power people have when applying for a loan. However, it’s important to know that many lenders are still offering great rates despite the hike. Let’s take a closer look at how this affects potential borrowers.

Mortgage Payments Increase

The BoC’s decision to raise interest rates means that mortgage payments will become more expensive for people with variable-rate mortgages or lines of credit. For those who are on a fixed-rate mortgage, however, the effect may not be felt right away as they have already locked in their rate and payment schedule. They will see the effects once their mortgage renewals come up.

Reduced Borrowing Power

When applying for a loan or mortgage, lenders typically consider your debt-to-income ratio. This is calculated by dividing your total debt payments by your gross income over a 12-month period and multiplying it by 100; if it exceeds 40%, you may be seen as too much of a risk and have difficulty being approved for certain loans or mortgages. With higher monthly payments due to an increased interest rate, this can affect your borrowing power since you’re paying more towards debt each month than before the rate hike.

Great Rates Still Available

Despite the recent increase in the BoC’s key interest rate, many lenders are still offering great rates on loans and mortgages, especially on a locked in 5 year mortgage—which could help offset some of those expensive mortgage payments. Before deciding on a lender or loan package, make sure to shop around so you can find one that works best for you; if you see an offer that looks too good to be true, check out its fine print so you don’t get hit with any fees down the line! Also try and negotiate your rate as much as possible.

The Bank of Canada’s decision to raise their key interest rate has had an impact on mortgages across the country—variable-rate mortgages and lines of credit will likely experience higher monthly payments due to an increased interest rate while potential borrowers may find themselves with reduced borrowing power. However, there is some good news: many lenders are still offering great rates on 5 year fixed loans and mortgages so make sure to shop around for one that fits your budget! Contact me if you’re looking to Buy, Sell or Rent in Orleans or surrounding regions.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link